Household fairness loans and residential fairness lines of credit rating are borrowed from the level of equity you have developed up in your home (the value of your house minus the amount you've got compensated down).

Curiosity fee. This is basically what the lender is charging you to borrow the money. Your curiosity charge is expressed as being a percentage and could be preset or variable.

Rapidly Loan Immediate highlights the importance of an crisis fund and quick monetary options for instant requirements.

This data is utilized to avoid fraud. Lenders won't ever Get in touch with your employer to reveal your loan inquiry. In case you are on Added benefits, enter your Positive aspects service provider's cell phone number.

When evaluating delivers, be sure to assessment the economical institution's Stipulations. Pre-qualified features are usually not binding. If you discover discrepancies together with your credit history rating or info out of your credit history report, please Call TransUnion® straight.

Enter the home rate. Start off by incorporating the total invest in price tag for the house you’re seeking to obtain about the still left side of the monitor. When you don’t have a particular home in your mind, it is possible to experiment with this particular quantity to check out the amount of residence you can find the money for.

Savings account guideBest financial savings accountsBest higher-yield savings accountsSavings accounts alternativesSavings calculator

Although It truly is beneficial to be aware of the particular behaviors in your personal credit history, the categories of behaviors that can decrease your credit rating score are well-recognised on the whole phrases. Being familiar with them can help you concentration your credit score rating-making strategies:

Borrowers with weak credit score may well qualify to get a undesirable-credit history private loan, on the other hand, you are able to transform your chances of qualifying and lessen your fee by acquiring a joint, co-signed or secured personal loan.

Contemplate a personal debt-management plan. If you're acquiring problems repaying your loans and bank cards, a financial debt-administration strategy could provide some relief. You work which has a non-earnings credit history-counseling company to work out a workable repayment routine. Entering right into a DMP successfully closes your bank card accounts.

Select a repayment term. Own loans ordinarily have repayment phrases from two to seven years. A loan which has a lasting has decrease regular payments, when a shorter-expression loan fees much less in desire. Hunt for a repayment phrase that balances inexpensive payments and small fascination expenses.

Watch our property buying hubGet pre-permitted for any mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs buy calculatorHow Considerably here am i able to borrow mortgage loan calculatorInspections and appraisalsMortgage lender reviews

We don't offer you fiscal tips, advisory or brokerage providers, nor do we propose or suggest people or to order or market specific stocks or securities. Functionality information could have adjusted Considering that the time of publication. Earlier performance is just not indicative of potential results.

Fork out your bills promptly. Indeed, you have listened to it right before. But there is not any much better approach to transform your credit rating rating. When you've got accounts which are past-due or in collections.

Rick Moranis Then & Now!

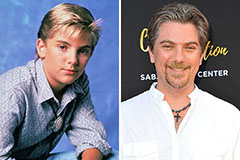

Rick Moranis Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!